Our Ethos

Our investment philosophy is to generate long-term alpha through robust bottom-up research in less efficient markets.

Investment pillar

Innovation

Acorn Capital believes that innovation can create sustainable competitive advantages through addressing specific challenges that achieves value for both the company and customer. In our experience, smaller companies take the lead when it comes to innovation and the ones that survive are likely to thrive.

Investment pillar

Efficiency

Acorn Capital believes that companies with the lowest economic cost in a given industry should be rewarded in the long term with a relatively lower cost of capital, which we hope will translate into higher returns to shareholders.

Investment pillar

Growth

Acorn Capital believes that smaller companies make an outsized contribution to economic growth, particularly employment outcomes. High growth firms are not necessarily a type of firm rather a description for a stage of development in some company’s life cycle.

Investment pillar

Diversity

A diversity in thinking and behaving can lead to areas of opportunities that over people overlook. The identification of market inefficiencies within capital markets provides the opportunity to generate outsized investment returns. Our track record has demonstrated our ability to do this within small and emerging companies building the great businesses of tomorrow.

Investment Process

Distinctive + Detailed

Acorn Capital’s investment process is underpinned by the depth and breadth of our research capabilities to identify a company’s competitive advantage, and its upside and downside risks to consult a well-diversified portfolio of stocks. We combine our industry knowledge with understanding of the different development stages of growing companies to determine each stocks’ potential reward and risk outcomes.

Our investment process has been developed over the last 25 years and demonstrated our ability to generate returns through bottom up research and backing great companies rather than timing or picking macroeconomic trends. We believe that great businesses can defend its business model through all economic cycles, growing from a small company today to a blue chip in a decade’s time.

Why Acorn Capital?

"We focus on the areas others find more difficult or struggle to price, and this is where the greatest inefficiencies and richest opportunities lie."

Robert Routley, Acorn Capital CEO

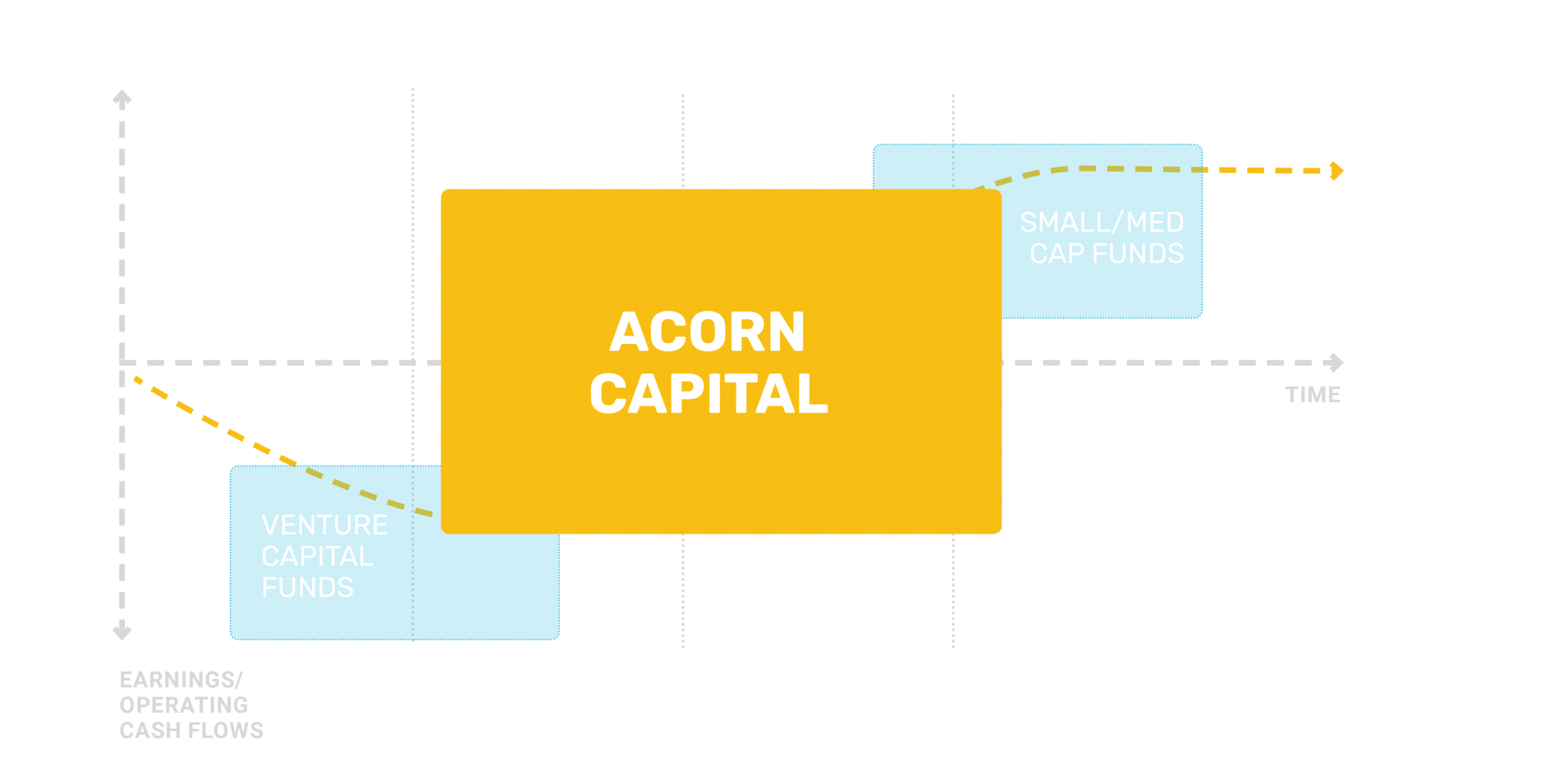

Opportunity Spectrum.

The investment universe of emerging companies covers the investment spectrum across the early, expansion and mature growth stages of development. This matches the funding sources provided by venture capital funds, microcap funds and small/midcap funds.

Investment process.

The investment universe is particularly inefficient and capturing this requires particularly rigorous company level analysis…the key to investing successfully in the sector is getting the stage of development right.

ESG

Responsible investing

We believe that ESG issues can have a direct impact on the risk and value of our investments. Incorporating ESG assessment enhances our knowledge and understanding of a company’s management, culture and business strategy, and enables us to make better informed investment management decisions of behalf of our customers.

Our ESG risk assessment involves considering the potential financial impact of material sustainability issues from an investment standpoint and is informed by the SASB Materiality Map to drive focus to the most relevant and material ESG risks that are most likely to interact with the fundamental value of the firm. We also look at any controversies for potential future liabilities that may impact valuation, and to assess management ability and organisational culture.